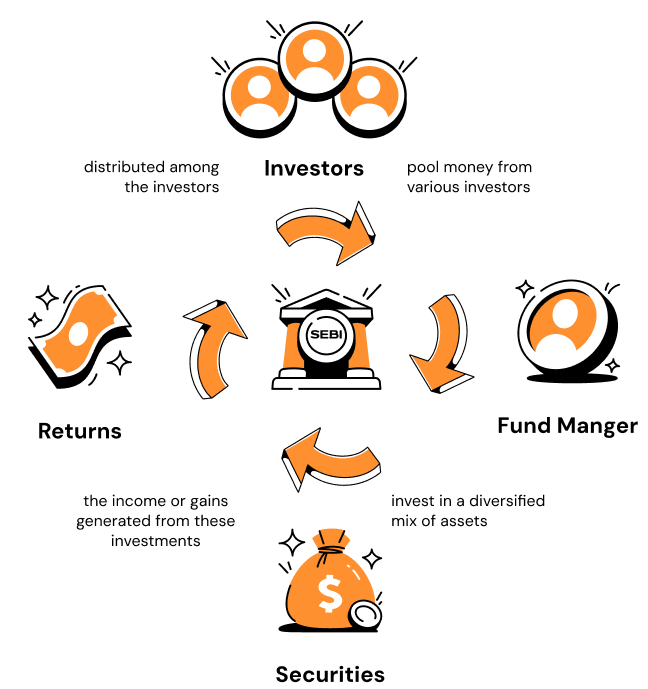

Mutual funds pool money from various investors to invest in a diversified mix of assets like equities, bonds, and money market instruments. Managed by professional fund managers, the income or gains generated from these investments are distributed among the investors based on the scheme’s Net Asset Value (NAV).

Imagine you and your friends contribute ₹10 each to buy a box of chocolates worth ₹40. You each receive 3 chocolates (or units), proportional to your investment. Similarly, when you invest in mutual funds, you own units, and your returns depend on the NAV, which fluctuates based on market performance.

Mutual funds are ideal for those who want to grow their wealth but lack time or expertise to manage investments. Professional fund managers invest your money according to the fund's objectives, while regulatory bodies like SEBI ensure transparent, fair practices.

Protip offers Direct and Regular Plans for investments, so you can choose the best fit for your goals.

Open-Ended Funds: Invest and redeem at any time.

Closed-Ended Funds: Fixed investment period, with units traded on exchanges.

Active Funds: Managed by professionals to outperform market benchmarks.

Passive Funds: Track market indices, with lower fees. Track market indices, with lower fees.